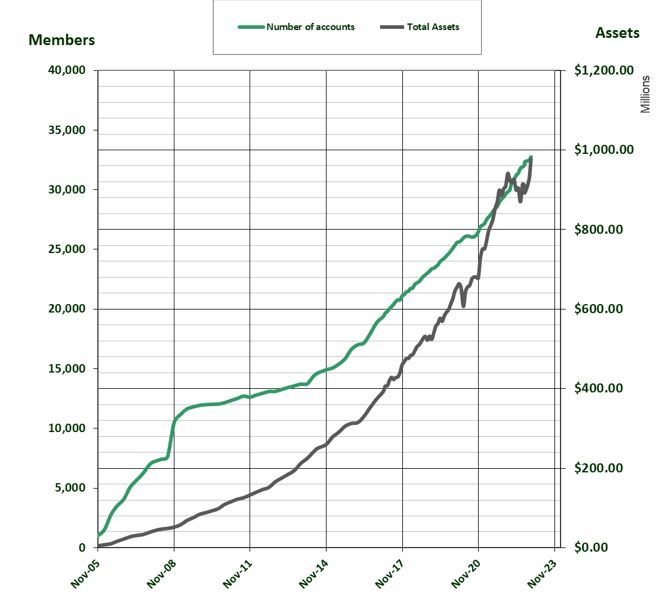

CEIRP continues to experience steady growth, despite the pandemic and market fluctuations. The funds offered through CEIRP are designed to keep pace when markets are rising and to protect capital when markets are more challenged. The first table below illustrates the annual growth of the assets and membership.

| Assets | Members | |

|---|---|---|

| 12/31/2022 | $961,833,335.39 | 32,890 |

| 12/31/2021 | $940,763,231.99 | 29,843 |

| DIFFERENCE | $21,070,103.40 | 3,047 |

| % GROWTH | 2.24% | 10.21% |

This second table details the annual contributions between 2018 and 2022.

| 2018 | $103,553,587 |

|---|---|

| 2019 | $115,034,749 |

| 2020 | $87,085,600 |

| 2021 | $150,737,514 |

| 2022 | $154,013,674 |

The exceptional growth of the plan, illustrated by the graph below, has resulted in a continuous reduction in the investment management fee since the inception of the plan. In 2021, CEIRP’s Investment Management Fee (IMF), was reduced for the seventh time and is currently sitting at 0.48%. Comparatively, mutual fund fees can be as high as 2.65% or more. In addition, the fees may include front-end or back-end loads, deferred sales charges and trailer fees. Over time, low fees make a big difference because it allows members to save more of their money.

To learn more about CEIRP’s Investment Management Fees, click here.

Click here to download the PDF version of the this graph.

Analysis provided by Canada Life

Geopolitical uncertainty stoked market volatility in 2022 and will continue influencing markets in 2023. In Europe, the war in Ukraine reshaped how governments think about energy security and contributed to the highest inflation in decades. In the U.K, a sudden announcement of unplanned tax cuts contributed to a massive sell-off in U.K. government bonds as the British pound depreciated. There is also growing potential for evolving U.S.-China relations to upset economic stability in Asia.

2022 proved to be a challenging year in the financial markets, due to the highest inflation experienced in over forty years. The inflation was brought due to a few factors such as the war in Ukraine, supply chain challenges and tight labour markets. All these factors also contributed to higher interest rates, which resulted in the weakest returns in the bond market in over forty years. This was experienced in equity markets around the world.

Despite all the challenges, the prudent nature of the investments in the CEIRP plan — the Cadence Target Date and Portfolio Target Risk funds — have performed better than the broader markets. The funds continue to look to alternatives to further diversify the portfolios, all with the pursuit of strong risk-adjusted performance. There have been further enhancements in the ESG approach that the team is adopting with a risk management lens on the portfolios, all with the pursuit of delivering positive outcomes to plan members.

Expense Recovery Disbursement In February, the Retirement Committee adopted a resolution to distribute 25% of the Expense Recovery Fees paid by Canada Life to CEIRP, back to the participating Locals and Guilds that incur administrative expenses related to their participation in the plan. These disbursements were retroactive to the beginning of the year and are being paid on a quarterly basis.

CEIRP Strategic Planning Retreat In April, the Retirement Committee, CEIRP staff and the Canada Life account executives met with a consultant in Calgary to discuss ways for the plan to operate more efficiently. The group identified key strategic initiatives and developed a list of action items that can be achieved in the short, mid and long-term. Chief among these goals was to allow plan members’ families to also join the plan. This update was achieved on January 1, 2023.

Annual Administrators Meeting Once again, due to the pandemic, the annual meeting was held virtually on November 24. CEIRP administrators from across the country were updated on new developments introduced by Canada Life. One important change was the ability of plan members to now manage their accounts online, thereby bypassing the Canada Life call centre if they preferred. In 2023, the next plan administrators annual meeting is scheduled to be in person.

The AFC CEIRP continues to support and promote the important work of the AFC. The AFC’s mission doesn’t stop at providing emergency financial aid, they also have a number of programs and workshops to assist the creative community in navigating a career that can be tough at the best of times. CEIRP encourages plan members to contact the AFC whenever they are facing financial difficulties.

New Additions to the Plan CEIRP welcomed the members of three more locals to the plan:

- IATSE Local 523, a stage local in Quebec City joined the plan on January 1, 2022

- IATSE Local 863, a stage local in Montreal joined the plan on April 1, 2022

- IATSE Local 250, a new stage local based out of Penticton joined the plan on May 15, 2022

Communications CEIRP continues to work with the participating locals and guilds to provide customized presentations, which are primarily virtual at this time. The goal is to help members to have a better understanding of the plan and all it has to offer. Executive board members and office staff are welcome to attend as well so that they also have a general knowledge of the plan, especially as they represent members’ interests. Everyone is encouraged to read the monthly newsletter to stay up to date with important information from the office and from Canada Life, to discover the wealth of information on the website, www.ceirp.ca, to follow CEIRP’s social media communities Facebook, Twitter and Instagram, and to promote the plan through their own social media. Contact Sarah Twomey, CEIRP’s communications and education specialist with comments or suggestions for specific financial topics, at [email protected].

A reminder to plan members about keeping personal information up to date It’s important to update your personal information, including your email address, by accessing your account on mycanadalifeatwork.com or by calling 1-855-729-1839, Monday to Friday from 8 a.m. – 8 p.m. ET. Staying up-to-date allows you to continue receiving important plan news and protects your privacy.