Time to retire?

Things to consider as you get ready – and beyond

When you retire, you may stop working, but your money shouldn’t. It’s time to put your savings to work! Did you know that if you keep your money working, you will likely make more after retirement than you saved before you retired?

Where to start

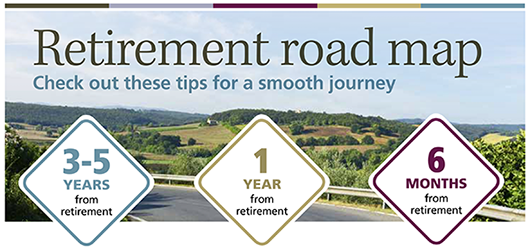

Use Canada Life’s “Road Map to Retirement”

This handy checklist provides tips and action items to make sure you’re ready when the time comes.

CEIRP RRIF

Through CEIRP, you have access to a group registered retirement income fund (RRIF) that can help you transition into retirement and turn your hard-earned registered retirement savings of $10,000 or more into a flexible source of retirement income.

Other retirement income options

You may also be able to use a combination of the following options, depending on where your savings are currently:

Combine your savings

If you haven’t already done so, consider combining other savings you have into your CEIRP RRSP or TFSA. It’s more convenient and you’ll typically pay lower fees compared to retail investments.

Learn how to combine/transfer savings

Learn more about government programs

Make sure you understand what you can expect in retirement from government programs such as CPP/QPP and OAS.

To discuss your retirement income options, call Access Line at 1-833-531-6418, Monday to Friday from 8 a.m. to 8 p.m. ET, and ask to speak with one of CEIRP’s dedicated Investment and Retirement Managers.

smartPATH can help you get ready to retire

Visit this interactive website for educational tools and resources to help you turn your savings into retirement income.

The link below will take you to the “Preparing for Retirement” page of the website.