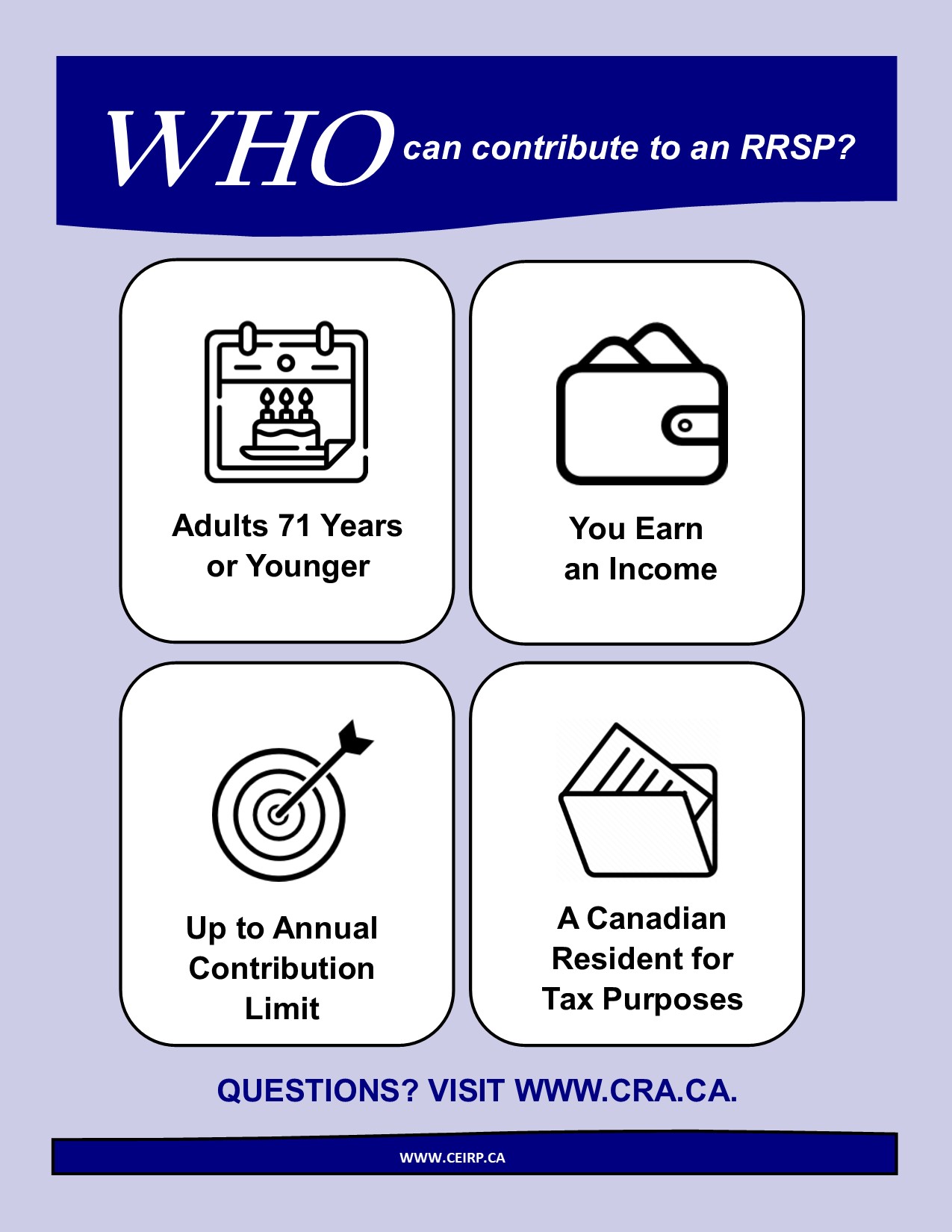

The simple answer is a Canadian resident for tax purposes who is 71 years or younger and making an income, up to the individual’s annual contribution limit.

So, what if you’re on a temporary work visa or you’re a Canadian citizen who’s lived overseas for a while and have now moved back? The CRA website covers these questions on its Working in Canada Temporarily page. To start, it states that in Canada “your income tax obligations are based on your residency status, not on your citizenship or immigration status.” If you earned an income while here, regardless if you plan on staying in Canada, you may be required to file a tax return. If you’re unsure of your tax filing obligation or resident status, visit Working in Canada Temporarily and/or Newcomers to Canada.

With all this said, if you are clear about your residential status in Canada, you are eligible to contribute to an RRSP. If you have additional questions, consult the CRA website for more information and resources.