Analysis provided by Canada Life

Following one of the most challenging years in recent history, the markets started 2023 with the same kinds of pressures including high inflation, rising interest rates and geopolitical unrest. Many economists across the country predicted that these trends were pointing towards a recession and this concern was reflected in the market’s behavior.

As the year progressed, confidence grew that inflation would return back down to the Bank of Canada’s 2% target. This resulted in the reduction in bond yields and the rise in stock prices, particularly in the tech sector.

With respect to the CEIRP plan, the Cadence Target Date Funds’ performance improved with a return ranging from approximately 7.8% to 12.2% (depending on the target date). In addition, the Portfolio Target Risk Funds achieved returns ranging approximately 8% to 12.4% (depending on the risk-based fund). The Socially Responsible Balanced Fund obtained a 10.1% return. These results were a significant rebound to what was experienced in 2022.

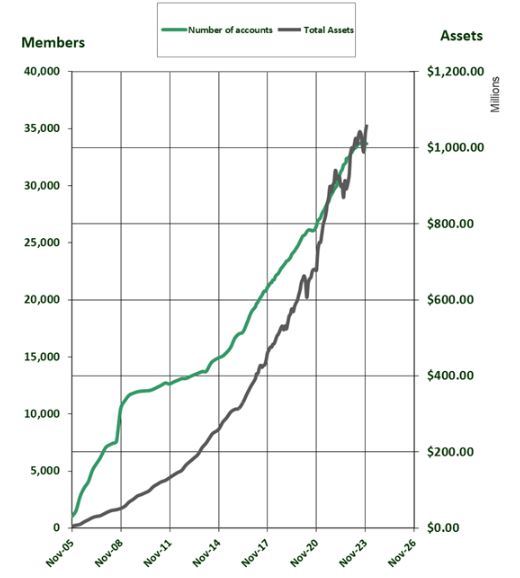

As the plan grows to $1 billion, more members are on their way to realizing their retirement goals.

| ASSETS | MEMBERS | |

|---|---|---|

| 12/31/2023 | $1,061,187,672 | 33,662 |

| 12/31/2022 | $961,833,335 | 32,890 |

| DIFFERENCE | $99,354,337 | 772 |

| % GROWTH | 10.32% | 2.29% |

Annual Contributions (in dollars)

New contributions only, not including funds transferred in from existing plans.

2020 and 2021 – Live events shuttered

2023 – Film industry labour disputes in the USA

| 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| 115,034,749 | 87,085,600 | 150,737,514 | 154,013,674 | 101,281,848 |

2023 Annual Administrators Meeting

Last June, with the pandemic finally over, the CEIRP administrators from across the country were once again able to meet in person. Canada Life hosted the meeting at their head office in London, Ontario. These face-to-face meetings are crucial in maintaining strong relationships across the plan and the country, keeping everyone on track, and giving everyone the opportunity to discuss and strategize on issues of mutual interest as part of their professional development. The plan administrators met with the Customer Service Specialists (CSS) and the support personnel they deal with on a daily basis. They were also provided with a virtual tour of a typical day in the life of a CSS to get a better understanding of their processes and procedures. To cap off the afternoon, our hosts gave us a tour through the grand historic Canada Life building. Everyone was particularly charmed by the archival photos of employees from the early days of the company.

The tour was followed by a casual meet-and-greet with the members of the Retirement Committee, who were also in town for their annual face-to-face meeting scheduled for the next day. Prior to these June meetings, member assets in the plan achieved the phenomenal milestone of $1 billion, but the strikes overshadowed the good news and the planned announcement was cancelled.

Search for a Consultant

Earlier in the year, a number of group plan consulting firms were invited to submit proposals to provide CEIRP with ongoing advisory services and to assist the Retirement Committee in meeting their fiduciary responsibilities. After careful review and candidate interviews the candidates during the 2nd quarter meeting in June, the unanimous decision was made to offer the consultancy to Eckler Ltd. CEIRP, the IATSE and the DGC have all worked with the firm on various projects for many years.

Customized Plan Presentations

Our goal is to help members to have a better understanding of the plan and all it has to offer. By continuously working with participating local unions and guilds, CEIRP provides customized presentations that suit their needs. We encourage Executive Boards and office staff to attend, especially as they represent members’ interests.

Stay In Touch

- Staying up to date with important information in the CEIRP monthly newsletter and messages from Canada Life

- By discovering the wealth of information on the CEIRP website, www.ceirp.ca

- By following CEIRP’s social media communities Facebook and Instagram

Contact Sarah Twomey, CEIRP’s communications and education specialist, with comments or suggestions for specific financial topics, at Sarah@ceirp.ca.

Keeping your personal information up to date

Staying up-to-date protects your privacy and allows you to continue receiving important plan news. Update your personal information, including your email address, by accessing your account on mycanadalifeatwork.com or by calling 1-855-729-1839, Monday to Friday from 8 a.m. – 8 p.m. ET.

The Cascading Effects of the WGA and SAG-AFTRA Strikes

Now with the pandemic behind us, 2023 started out full of promise for workers in the entertainment industry. Unfortunately, that would not last. South of the border on May 2, 2023, the Writers Guild of America (WGA) went on strike over pay by the Alliance of Motion Picture and Television Producers (AMPTP), streaming residuals and the yet unknown affects of AI. SAG-AFTRA (Screen Actors Guild-American Federation of Television and Radio), fighting most of the same issues, commenced strike action July 14, 2023. The Writer’s strike lasted an extraordinary 148 days. Two months later, with 118 days on the picket line, the Actor’s strike also ended. The resulting work stoppages in the US had considerable affects on our Canadian Crews.

Financial Support Considerations

The CEIRP Retirement Committee, representing the IATSE and DGC, closely monitored the strikes and the unprecedented impact the labour unrest was having on Plan members in the Film & TV sectors. They made sure members facing financial difficulties were informed of their options to help ride out the downturn in employment. Members were encouraged to apply for employment insurance benefits as soon as possible, talk to their property owner, bank or creditor, and apply to the AFC for emergency financial aid. As the SAG-AFTRA strike continued, the Retirement Committee, as a last resort, enacted a temporary policy to allow Plan members, demonstrating dire need, to access their restricted retirement funds in monthly increments and agreeing to payroll deductions of a minimum 5% once they resumed employment in the industry.

The AFC

The AFC’s mission does not stop at providing emergency financial aid; they also have numerous programs and workshops to assist the creative community in navigating a career that can be tough at the best of times. CEIRP continues to support and promote the important work of the AFC and encourages plan members to contact the AFC whenever they are facing financial difficulties at www.afchelps.ca.

Motivation to Increase Contributions

It would not surprise anyone that shutting down segments of the entertainment industry due to a pandemic or labour actions would inevitably lead to much reflection. While no one wanted or planned to take months — or years — away from the job they love, this scenario became much of our members’ reality. With dwindling resources causing undue stress, many members turned to their retirement saving for help. CEIRP has always encouraged plan members to increase their payroll deductions to give themselves a cushion in the event of work slowdowns, which are normal in the industry. Nevertheless, are the locals/guilds doing enough in their negotiations with employers/producers to ensure that the payroll contributions negotiated today are adequate for retirement down the road? Percentages in collective agreements and employment contracts vary widely across the industry, some, but not many, require a contribution by the member. To address this, the Retirement Committee is investigating how much is enough. And, more importantly, how to convince Employers, Producers, Unions, Guilds, and Members, of the necessity to increase contributions meant for retirement.

Extended Plan for Family Members

Immediate family members are invited to join the plan, provided they meet eligibility requirements. Family members are eligible to open a Registered Retirement Savings Plan and/or a Tax-free Savings Account (TFSA).

- For an RRSP, they must have an earned income, filed taxes in Canada and be at least 16 years of age in order to contribute more than $2,000 per year.

- TFSA eligibility is based on age — they need to be at least 18 or the age of majority in their province, a resident of Canada and have a valid social insurance number.

Shortened Wait Times, Speedier Access to Information You Need

Canada Life and CEIRP have created a dedicated call centre phone line for members: 1-855-729-1859. After selecting your language preference, press “2” for retirement and savings plan inquiries, Monday to Friday, 8 am to 8 pm ET.

Canada Life Health and Wealth Consultants

Regardless of your age, income or financial expertise, the new dedicated Canada Life Health and Wealth Consultants are here to help. They are a free benefit from CEIRP that can empower you to make informed choices about your physical, mental and financial well-being. Services include:

- Helping you select the right savings plan for you

- Understanding and optimizing your savings plan to help reach your goals

- Taking advantage of other Canada Life tools and resources

- Manage your plan online using My Canada Life at Work™

- Book a meeting using our QR code

My Canada Life at Work ™ Combined Benefits and RRSP Access

Now, you can access your GroupNet and GRS accounts with one login and password. My Canada Life at Work™ lets you:

- Set up online contributions

- Set a retirement savings goal

- See your savings summary overall by plan type, and more!