New! Canada Life Webinars and Videos

Reminder: Is it time to fine tune your investment risk tolerance?

Notice: The CEIRP Newsletter will reduce to two issues this summer, June/July and August/September.

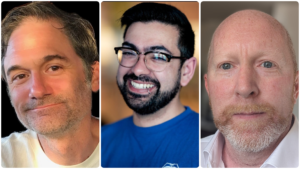

L-R: Wes Allan, Harrison Bye, Chris Hains

A Focus on IATSE Local 58

The members of IATSE Local 58 in Toronto have one thing in common: a love for theatre. This was evident when CEIRP met with Harrison Bye, Chris Hains and Wes Allen for this Member Spotlight.

Harrison and Chris went to the School of Performance at the Toronto Metropolitan University (formerly the Ryerson Theatre School). Wes was first exposed to the field through a theatre production course in high school and while at the University of Toronto, he worked part-time at a local theater. Wes enjoyed this work more than his studies, so he chose to leave school and apprentice with Local 58. As their careers developed, they learned that joining the union meant that they could make a good living and look forward to a comfortable retirement. Effective money management became a priority for all three, and that solution was CEIRP.

When did you join CEIRP?

Harrison: CEIRP wasn’t the group RRSP plan when I first joined Local 58. I joined the plan in 2020 and after a while, I noticed how well my investments were doing. That’s when I decided to transfer all my RRSPs into the plan. Right now it’s mandatory for all new apprentices to be enrolled in CEIRP.

Wes: It was probably nine years ago and I was on the executive board of the local. CEIRP gave a presentation about the plan, and I learned more about mutual funds and different types of investments. When the local decided to join the plan, I decided to lead by example by being one of the first people to enrol. I thought the target date/risk funds were perfect for me because I liked that the funds would be auto-tuned every five years to keep the investment on track.

Chris: I used to be very bad with my money and used withdraw from my RRSP when I was with the other plan. Then I heard about CEIRP and moved all my money over. Now I’m more diligent and leave it alone to grow. I attend the conventions and last year I learned that with every $100 million, the fees go down. I tell anyone that’s willing to listen that they need to transfer over to CEIRP. The returns are great and the fees really make it worthwhile.

What has your CEIRP experience been like?

Harrison: Transferring from the other provider was easy and seamless. I was well supported by the team at Canada Life and by our local’s plan administrator. People took care of me and they followed up. It was a very positive experience.

Wes: I trust the plan and I’m not worried. It’s doing its thing in the background. I think the increased buying power to reduce fees is a good thing. And I feel good that it was created for people in our industry.

Chris: Everything’s been great. I tell everyone to join.

Do you have an idea what your retirement might be like?

Harrison: I think about it often. And it’s a massive selling point when I’m promoting this plan to younger members. When I think about my retirement, I think it would be a reflection of my life today, just more relaxed and comfortable.

Wes: I would like to travel more, provided that I’m healthy and that I have enough money. And I’d like to own a house at some point.

Chris: I have a dream: beach front property in Sicily. But in reality, I may just retire here with my girlfriend. I love my job but I look forward to being able to enjoy the sun on a patio, playing golf, and visiting with friends and family.

What would be your pitch to another member of your local who was contemplating joining the plan?

Harrison: Members don’t realize how big the plan is, and how well supported we are [by Canada Life, the plan provider]. To younger members, I tell them that you can’t have this kind of a positive experience at a corporation. Some aren’t signed up yet and others aren’t fully aware of the plan or its benefits.

Chris: The rate of return, regardless of when you retire, and the fees make a huge difference. You don’t have to be an expert, Canada Life does all the work for us. Just make sure your money goes there. This is easy. It’s a no brainer. You can trust it because it’s been around for 20 years.

Wes: I talk about how it was something created by and tailored to those working in the entertainment industry. And about the personal service that we get. The way the funds work based on your age, how easy that is, especially for younger people; the sooner you join, the better. This article is also a good reminder for members to look into the plan if they haven’t yet.

Financial experts advise that there are two things we all should do as part of a good personal financial plan. First, they advise that we should save up to 10% of our earnings as part of a “pay yourself” habit. And second, they say that a portion of those savings should be set aside as an emergency fund.

The good news for CEIRP members is that you can open a Tax-Free Savings Account (TFSA) through the plan and then you can set up regular transfers through your banking as bill payments.

- By automating the transfer, you will barely notice that it’s been reallocated.

- Also, you’re able to take advantage of Canada Life’s funds, low fees and your savings will grow tax free.

- All this means that your emergency fund will grow quickly and you’ll be ready in case of an emergency.

Click here to learn more about the TFSA. And click here to go to Canada Life’s Smartpath Now website to learn more about emergency funds.