Set Up a TFSA as an Emergency Savings Account, instead of using your RRSP

One of the biggest selling points about the TFSA (Tax Free Savings Account) is that your money grows tax free, and you can access it when you need it — tax free. This feature also makes it an ideal savings tool to save for emergencies, instead of using your [...]

Manage the Industry Ups and Downs with a TFSA Strategy

Working in the Canadian entertainment industry is exciting. But the work may not always be steady. You might have a good stretch of projects and then things slow down. Not knowing when things will get busy again can be stressful emotionally and financially. One way to avoid the stress [...]

Member Spotlight: Leslie Brown

When you sit down with Leslie Brown to chat about her career in theatre, a few things are abundantly clear: her joy and curiosity have been her guides, and life never moves in a straight, predictable line. Leslie’s story starts at the end of high school. Like [...]

Prepping for Tax Season

Over the last few years, we’ve shared articles and tips to help you get ready to file your taxes. Here is a reminder of those pieces and some other links that you might find useful: Canada Life’s Policy Regarding Tax Slips and Statements Where to find your tax receipts [...]

2024 Annual Report

Analysis provided by Canada Life Global central banks made a major shift in 2024 to start rate-cutting cycles as inflation eased. Interest rates are expected to keep declining, although there’s still a risk inflation could rise again. Based on incoming economic data and in response to slower economic growth, [...]

“Spring Forward” Financial Check-Up

Each year when we spring forward or fall back, we’re reminded to check the batteries in our fire alarms. This also a good time to do a check up on your financial arrangements. For example: Have you designated your beneficiary? If you have, are you still happy with your [...]

Access Inexpensive Will and Estate Planning Services as a CEIRP Member

Did you know that CEIRP members can access will and estate planning services from Canada Life? These important decisions for the later part of your life are also essential to a comprehensive financial plan. Just log on to My Canada Life at Work and then click on “Options for [...]

Updated: Managing your NRSP to RRSP Transfers Yourself is Easy!

One of the most common calls that the Canada Life call centre receives is about transferring money between a Non-Registered Savings Plan (NRSP) and Registered Retirement Savings Plans (RRSP), especially near the end of the year. Now members can manage the process themselves just from this screen. No forms [...]

Updated: Tips on Managing Your Debt from the Experts at Canada Life

The first step to managing your debt is to understand the difference between good debt and bad debt. Good debt helps you to build on an asset, like your mortgage or to finance your education. Bad debt occurs when you borrow money to purchase an item that reduces in [...]

Updated: Transferring your investments from other financial institutions into CEIRP

Spreading your savings between multiple financial institutions can make managing your investments unnecessarily complicated. Consider consolidating them into CEIRP. Here's how. 1) Book a meeting with a Canada Life wealth consultant who are available Monday to Friday between 8am and 8pm ET. They will: Complete the required transfer form(s) [...]

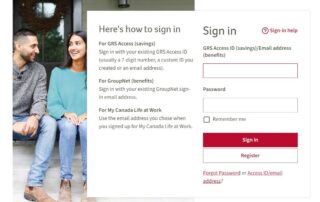

Managing your CEIRP account is easy on My Canada Life At Work

Get flexibility in how and where you access your group savings information with Canada Life’s member site: My Canada Life at Work™. Managing your savings is easy with My Canada Life at Work. Access your plan information where and when you want. Set a retirement goal and track your [...]

January 2025 Newsletter

January is the beginning of the RRSP season. The deadline this year is March 3, which is a Monday. Download all the important dates here: 2024-25 Deadlines for RRSP and TFSA Contributions The next CEIRP Onboarding Presentation will be held on January 27 at 1pm EST. Registration invitations will [...]

Member Spotlight: Two CEIRP members who emigrated to Canada

This edition of the Member Spotlight focuses on two CEIRP members who emigrated to Canada. First, we met with Cici Clancy of DGC Ontario who arrived from Ireland in 2017. And then we met with Celest Prodon of IATSE 856, who emigrated from Nigeria and settled in Winnipeg forty-four [...]

2024-25 Deadlines for RRSP and TFSA Contributions

For your convenience, the "Important Deadlines for RRSP and TFSAs" information sheet for this upcoming season is now available. Click here to download the document. Holiday hours GRS administration offices will have limited hours on Tuesday, Dec. 24 and will be open until noon. The Client Service Center will [...]

November Newsletter: Financial Literacy Month

New! Onboarding Presentation Each month, we will be hosting a bilingual CEIRP plan presentation for all members. Be sure to look out for your invitation to register in mid-November. The next presentation is set for November 25 between 1-2pm ET. New! From The Desk of the National Administrator To [...]

CEIRP Helps You to Improve Your Financial Literacy

One of our mandates as providers of this plan is to provide you with information that will help you save for retirement and to reach your other financial goals. To achieve this, we designed our website to be your primary information hub. Here are some key sections that you [...]

Are you on track with your 2024 RRSP contributions?

As a CEIRP member, you have access to free Canada Life Health and Wealth consultants who can help you make the most of your membership, including: Providing advice on how you can maximize your RRSP contributions How to save for important goals Other financial or health related questions you [...]

Three Easy Steps to Plan Ahead for Holiday Season Spending

When the fall season arrives, its inevitable that retailers will have their Halloween and Christmas/end-of-year holiday merchandise and decorations on display. Sadly, these displays seem to appear earlier and earlier with each passing year. But retailers know that it does pique our interest; it gets us thinking until we [...]

October Newsletter

Reminder: Canada Life has launched a new webpage where you can reserve your spot for one of their upcoming Saving for Life webinars. Click here to access the website. New! Podcast recording with Nick Eddy from Creative Arts Financial who offers great advice to manage your money in the gig [...]

How to Keep Your Personal Information Up to Date on My Canada Life At Work

One of our important jobs at CEIRP is to keep you informed about your group retirement plan. The main way that we do that is through email. And as a plan member, one of your important jobs is to ensure that your information is current. It’s easy to do, here’s [...]

Choosing Your Beneficiary Is Mandatory

For every account you open with Canada Life, you must designate a beneficiary. This can be a person or an organization. (“Estate” is considered an organization). It’s easy, here’s how: Sign on to My Canada Life At Work and click on the Group Retirement Plan button. From the main [...]

August/September Newsletter

New Videos! "How To Open Your Account on Enrolment Express" and "The CEIRP Member Journey" Updated: Canada Life Launches Dedicated Webpage for Financial Webinars Reminder: How to Find Your Statements and Tax Receipts Reminder: Health and Wealth Consultants are here to help Reminder: Are you in the right RRSP [...]

UPDATED: Canada Life Launches Dedicated Webpage for Financial Webinars

UPDATED: New webinar dates! Click here to access the page. Canada Life has launched a new webpage that you can bookmark to see the dates of upcoming multi-employer education sessions. You can also enter your email address to get notification of when registration opens, which is great for those [...]

Getting Close: Advice about transitioning towards retirement

This article was first distributed by Canada Life several years ago. Since it’s been a while, we thought that it would be useful to republish for your convenience. You’ve worked hard to save for retirement. Now that you’re Getting Close, you will likely have many questions about the transition [...]

How to Start an Easy Christmas-in-July Money Saving Habit

When it’s gorgeous outside, the last thing you want to think about is the holiday season when it gets dark at 4pm and everyone is stressed out while they rush around getting their last minute items for the festivities. But, there is a way to make the season less [...]

June/July Newsletter

Reminder: Managing your savings plan is easy with My Canada Life at Work™. Reminder: Did you know that Canada Life has an app? Download it today from Apple or Google Play! Notice: The next CEIRP Newsletter will be in August/September. This article was first distributed by Canada Life [...]

Are you in the right RRSP fund?

Contributing to the CEIRP group savings plan means you’re in the driver’s seat — you decide where your contributions are invested. The Cadence Target-Date Funds are designed to generate more growth in the early years, progressing to become more conservative in the years nearing your selected retirement year. This [...]

Set up a TFSA as an Emergency Fund

Financial experts advise that there are two things we all should do as part of a good personal financial plan. First, they advise that we should save up to 10% of our earnings as part of a “pay yourself” habit. And second, they say that a portion of those [...]

Member Spotlight: A focus on IATSE Local 58

The members of IATSE Local 58 in Toronto have one thing in common: a love for theatre. This was evident when CEIRP met with Harrison Bye, Chris Hains and Wes Allen for this Member Spotlight. Harrison and Chris went to the School of Performance at the Toronto Metropolitan [...]

May Newsletter

New! 2023 Stakeholder Report New! Canada Life Webinars and Videos Reminder: Is it time to fine tune your investment risk tolerance? Notice: The CEIRP Newsletter will reduce to two issues this summer, June/July and August/September. L-R: Wes Allan, Harrison Bye, Chris Hains A Focus on IATSE Local 58 [...]

2023 Annual Report

Analysis provided by Canada Life Following one of the most challenging years in recent history, the markets started 2023 with the same kinds of pressures including high inflation, rising interest rates and geopolitical unrest. Many economists across the country predicted that these trends were pointing towards a recession and [...]

Decumulation 101: What is it and when should you start thinking about it?

As we all know, the primary focus of CEIRP is to help you save for a comfortable retirement. So, when you’re getting close, what comes next? Our plan provider Canada Life has posted a great article about the process on their website (How to decumulate your assets in retirement). [...]

Important Financial Conversations For Couples

This is the magical time of year when everything is waking up from a long winter’s slumber. The birds are nesting, tulips are blooming and trees are budding. Spring fever is definitely in the air. It’s also the time of year when some couples consider the next phase of [...]

Reminder: Canada Life’s Policy Regarding Tax Slips and Statements

Questions have been raised regarding Canada Life’s policy regarding tax slips and statements. As a reminder: Prior to September 2022, when members logged into My Canada Life At Work, they were prompted to accept the new Terms & Conditions which included receiving electronic statements, tax slips, etc., where available. [...]

When it Comes to Saving for Retirement, Let Your Imagination Be Your Guide

Twenty years ago, when CEIRP was first created, the purpose was simple — to help members to save for a comfortable retirement. Each of us have a dream of what our retirement might be like. Maybe it’s spending your time with friends and family. Or travelling the world. Or [...]

Updated: How To Find Your RRSP Contribution Tax Receipts

Looking for your RRSP contribution tax receipts? Find them on My Canada Life at WorkTM When tax season arrives, your tax receipts indicate the amount of RRSP contributions you can claim. To find the tax receipts related to your group RRSP: Sign in to your group savings plan at [...]

Contribute to your RRSP so you don’t leap over your 2023 tax savings!

2024 is a leap year – which means you have until Feb. 29 to contribute to your registered retirement savings plan (RRSP). Why contribute? Putting money into an RRSP can help lower your income taxes today, while saving for tomorrow. Also, money saved in an RRSP grows tax-free. You’re [...]

Time to Fine Tune Your Investment Risk Tolerance

Back when the minutes were ticking away the old year, were you thinking ahead to your new year’s resolutions? Now that we’re almost done with January, there’s one new habit you should adopt: review your investor risk tolerance. It’s very simple: just redo the investor risk questionnaire to see [...]

Start 2024 with a Refreshed Attitude Towards Your Money

We can all agree that the last few years have been difficult. Sometimes, our financial challenges may not have been just about our income. More often than not, it’s been tied to the decisions we make about how we use our money. And those decisions can be emotional, too. [...]

Member Spotlight: Gail Kennedy

In the late 70s, when Gail began her career as a make-up artist in Alberta, she and her husband were both working in theatre as members of Local 212. At that time, theatre companies didn’t make contributions to any retirement savings plan programs on behalf of employees. This [...]

Updated – Important Deadlines: RRSP and TFSA Contributions for 2023-24

Click here to download "Important Deadlines for RRSP and TFSAs". The Canada Life call centre hours during the holiday season: Thursday, December 21 - Open during regular hours Friday, December 22 – GRS administration offices will have limited hours and will be open until noon ET; The Client Service [...]

Start 2024 Off Right With This Easy Money Saving Hack

As we come to the end of a year that has been difficult for many CEIRP members, we can look ahead to 2024 as a fresh start, especially when it comes to how we manage our money. With this in mind, here is a simple money hack that you [...]

Financial Expert Chris Enns offers his advice for getting through these challenging times

Chris Enns is a unique financial advisor: he also has experience on the stage as an opera singer. Unlike other advisors, he has personal experience with the cyclical highs and lows of working in the entertainment industry. That’s why we asked him for his advice on how many of [...]

For Members Affected by the Strikes

Please be advised that after careful consideration and monitoring of the ongoing labour actions in the U.S. resulting in a considerable work stoppage in the film and television industries in Canada for the past 5 or more months, the CEIRP Retirement Committee has enacted a temporary revision to Policy [...]

The Importance of Having a Will and Designating your Beneficiary

It’s probably safe to say that not many of us have a written financial plan and maybe even fewer among us have a will. But, these are these are two very important pieces that help us to achieve our retirement and financial goals. So what would happen if you [...]

Amended: Message from the CEIRP Retirement Committee

The CEIRP Retirement Committee continues to closely monitor the impact that the WGA and SAG-AFTRA strikes are having on Plan members in the Film and TV sector of the entertainment industry. The Committee is very concerned about the ongoing labour unrest and its unprecedented impact on our Canadian crews. [...]

Additional Support for Those Affected by the WGA and SAG-AFTRA Strikes

As the industry strikes continue, we wanted to bring to your attention the following resources that may help you through this difficult time. The AFC AFC $2000 Emergency Aid Designated Sharing Time Credit Counselling Credit Canada Service Canada Employment Insurance Job Bank Other job search services Benefits Finder [...]

New Canada Life Webinars Coming This Fall

Get on track, stay on track Saving for retirement can feel overwhelming, especially when you’ve got other important things to save for and expenses to cover. Whether you’ve been saving for a while or are just getting started, this webinar will help you get on track for a retirement [...]

Mackenzie Market Insights – Mid-Year Review

Mackenzie Monthly Market Insights 2023 Capital Markets Mid-year in Review

A Message from the CEIRP Retirement Committee Regarding the WGA and SAG-AFTRA Strikes

Options to consider for Members faced with financial challenges Downturns in employment are not unusual in the motion picture industry and no one knows how long this one is expected to last. The Committee is exploring all possible alternative options to assist members during this difficult time. If you [...]

Mackenzie Monthly Market Insights – July 2023

Mackenzie Monthly Market Insights for July 2023

How Canada Life Manages Our Personal Information

Our plan provider Canada Life takes rigorous steps to ensure that they protect and manage our personal information according to the regulatory standards within the financial industry. Here’s what you should know: Canada Life collects and uses data from plan sponsors and members to administer their retirement program Only [...]

What You Should Know about the New Home Buyers’ Tax Free Account

Our plan provider Canada Life has gathered all the key points about the new First Home Savings Account (FHSA) in a short article. Here is a summary of everything you need to know: This new savings account will be launched in 2023 It combines some of the features of [...]

New Proposed Tax Credit for Tradespersons Tools

The 2023 federal budget proposes changes in the deduction for tradespersons tools. Here are the facts: The proposed change included doubling the maximum employment deduction for tradesperson's tools from $500 to $1,000. The new maximum deduction would be in effect for the 2023 tax year. Under the current rules, [...]

Update: Proposed RESP Withdrawal Limit Expansion

The latest federal budget includes changes to the Income Tax Act (ITA) that change the amounts that students can withdraw from their RESP accounts. Here are the facts of the proposed changes: The current rules allow for a student in full-time post-secondary education to withdraw a maximum of $5,000 [...]

A spotlight on Frank Haddad, Chair of the CEIRP Retirement Committee

At the end of March, Local 891 featured a member highlight article in its newsletter about Frank Haddad, Chair of CEIRP's Retirement Committee. We encourage everyone to read it. Click here for the full article.

Time to Spring-Clean Your Finances

According to a recent study by Stats Canada published at the end of March, Canadian credit card debt has increased to $91.5 billion. That amounts to a 13.8% increase in December 2022. If you’re looking to reduce your credit card use and to bring down your debt, consider trying [...]

2022 Stakeholder Report

CEIRP continues to experience steady growth, despite the pandemic and market fluctuations. The funds offered through CEIRP are designed to keep pace when markets are rising and to protect capital when markets are more challenged. The first table below illustrates the annual growth of the assets and membership. Assets [...]

Canada Life 2023 Webinar Schedule

Click here to download the PDF document.

Easy Ways to Track Your Budget

One important habit to adopt in order to become a successful budgeter is tracking your expenses. Luckily, there are a lot of options available to help make your life easier. Here are a few ideas: Spending apps: regardless of whether you have an Android or an Apple phone, you [...]

It’s Tax Season! Are You Taking Advantage of These Tax Credits?

Now that RRSP season is over, it’s time to look ahead to Tax season. While we know that many of you file with the help an accountant, others among you complete and file your taxes yourself. So the following short list of tips may be best suited to the [...]

How to protect yourself from identity theft

According to the latest Canadian Anti-Fraud Centre’s annual report, digital frauds like Phishing, Spear Phishing and Identity Theft continue to rise. In fact, they report that there has been a 130% increase in dollar loss compared to the previous year. Since this is Fraud Prevention Month, here are some [...]

Canada Life: MR Update About US Banking System

IMR Update Minimal Exposure to Faulty U.S. Banks Click here to read the statement.

Who to Call When You Have Questions

Here are the contacts where you'll find answers to your important questions. Still can't find what you're looking for? Send an email to [email protected]. For general information about the CEIRP, check out our website at www.ceirp.ca, or contact the CEIRP office at 416-362-2665. For questions concerning your taxes, [...]

Top financial goals for each life stage

Regardless of how old you are or how financially savvy, every life stage has an important money-milestone. Here are a few examples: Twenty-something: You’re starting to work and make money, so now is the time to learn how to budget — and it doesn’t have to be difficult or [...]

New! Manage your Canada Life accounts online with 1 login/password

Canada Life has now simplified how you log onto mycanadalifeatwork.com to manage your group retirement savings account and your health benefits. You can now sign on with just a single login and password! If you only have the Group RRSP and/or other savings accounts with CEIRP, click here to [...]

Tips on Managing your Post-Holiday Debt

There is one thing we can always expect after the holiday season: when the festive bubble bursts, the bills arrive and we realize that we should have done a better job budgeting for the holidays. We then start the year stressed because we have new debts to manage. So [...]

Market Matters: 2022 capital markets year in review

2022 capital markets year in review Presented by Mackenzie Investments Click here to read more.

Important Deadlines: RRSP and TFSA Contributions for 2022-23

Click here to download the "Beat the 2022 RRSP Deadline" PDF. Plus, download the "Important Deadlines for RRSP and TFSAs" here.

Canada Life launches new dedicated phone line (1-855-729-1839) and services for CEIRP members

Canada Life has announced the launch of new dedicated services on January 5, 2023, for CEIRP plan members: New dedicated phone line for CEIRP plan members - 1-855-729-1839 Canada Life health and wealth consultants Click here to learn more and to book an appointment with the new consultants. [...]

Market Matters: November 2022

November 2022 Review Presented by Mackenzie Investments Click here to read more.

Great news: Family members can join CEIRP as of Jan 1, 2023!

The Retirement Committee of CEIRP is pleased to announce that as of January 1, 2023, the benefits of the Group Plan are being extended to family members who meet the following eligibility requirements for a Registered Retirement Savings Plan (RRSP) and/or a Tax-Free Savings Account (TFSA): To be [...]

Understanding the timing of your RRSP contributions

We often hear from members about the timing of standard account transactions. We have collected the most common questions and answers for your convenience: Q: RRSP contribution receipts not matching details on paystubs and online banking contributions had not yet been processed into their plan. A: There are [...]

Updated Infographic: 5 Points to Remember about Your RRSP Limit

Click here to download the infographic.

Combining your other investments into CEIRP

One way that you can make the most of the CEIRP plan is to consolidate your other investments into CEIRP. Not only will you be able to take advantage of our well-managed investment funds, you can also take advantage of our low fees, which means you invest more [...]

Market Matters: October 2022

October 2022 Review Presented by Mackenzie Investments Click here to read more.

On behalf of the AFC: SmART Retirement Workshop

Here is an event that will be of interest for all members: The AFC presents: SmART Retirement Workshop Tuesday, November 8, 1-3 pm (ET) Free on Zoom Retirement can be daunting. For many of us, it looms in the distance as a hazy orb of confusion. When will [...]

How to reset your GRS login

You are able to reset your GRS login ID from the homepage of mycanadalifeatwork.com. Simply click on the images to enlarge.

Managing your account online is as easy as 1, 2, 3!

As we get closer to the end of the year and RRSP season, members like you want to know how they can manage their accounts without going through the Canada Life call centre. To start, go to mycanadalifeatwork.com and sign in to GRS Access (savings). You can retrieve your [...]

Tips on managing money anxiety

Almost on a daily basis across Canada, we are hearing news reports about how expensive life is becoming. It just seems as if today’s financial news isn’t very positive and it’s hard to know when things will improve. But there are adjustments we can do right now to [...]

Market Matters: Third Quarter 2022 Review

Third Quarter 2022 Review Presented by Mackenzie Investments Click here to read more.

CEIRP’s strength is the resiliency of our funds

The CEIRP investment committee has worked hard to create a retirement plan that manages risks when markets go down. Our plan offers the Cadence Target Date Fund and the Portfolio Target Risk Funds managed by Portfolio Solutions Group (PSG), which is a subsidiary of Canada Life. Both funds are [...]

A quick review of the RESP

Now that school is back in session, here’s a quick reminder of how the Registered Education Savings Plan works: It is a tax-sheltered account to save money for a child’s education Parents, grandparents, guardians, family members and friends can open an RESP It provides grants (CESG) and various [...]

What is the Life Long Learning Plan (LLP)?

If you and/or your spouse/common-law partner are thinking about going back to school, you can fund it by withdrawing $10,000 annually, up to a $20,000 maximum, from each of your RRSPs. Once you have finished your studies, you have ten (10) years to redeposit the amount you loaned [...]

Market Matters: August 2022

August 2022 Report Presented by Mackenzie Investments Click here to read more.

Market Matters: July 2022

July 2022 Report Presented by Mackenzie Investments Click here to read more.

Understanding your credit score

If you were looking to rent a new apartment, would you know how to check your credit score? Even if you’re not looking to move, having an idea of where you stand with your creditors is another part of having a solid financial plan. The good news is [...]

Paying yourself first pays off

Ask any financial planning expert and they will likely say that paying yourself first should be a priority for everyone. Even if you’re putting away a few loonies into a savings account each month, it does add up over time. Consider also putting a bit each pay or [...]

Understanding Market Volatility

Whether you’re an avid investor or someone who wants to start dabbling in the world of finance, the market has seen and continues to see its fair share of highs and lows and ebbs and flows. And here’s something to consider: Even though investing can feel like an emotional [...]

Video: How to remain calm in today’s investment conditions

Video — Straight Talk from Canada Life: How to remain calm in today's investment conditions

Make this the summer of TFSN: Tidy, Fix and Just Say No

We’ve all seen the headlines: almost every part of our lives is becoming more expensive. So here’s an idea that might help you out. Try the acronym TFSN — “tidy” up, “fix” it, and just “say no” thank you. Here’s how: Tidy: Maybe you don't really need more living [...]

Mid-year Money-management Check-in

We know that summer is a busy time for many of you. But we hope you’ll take a minute to do a quick check-in on your money situation. How are you doing? Are you meeting your goals? Even if you don’t have any goals, it’s never too late to [...]

Market Matters: 2022 Mid-Year Outlook

2022 Mid-Year Outlook Presented by Mackenzie Investments Click here to read more.

Summer fun on a budget

We know that the summer is a busy time for many of you. And the cost of living is high for everyone right now, too. But, seeing as it’s such a short season, we want to encourage you to enjoy it as much as you can with a few [...]

How to manage a CERB surprise

Recently, the CRA informed some CERB recipients that they had been paid too much and that they would now need to return the funds to the agency. Needless to say, this announcement shocked and worried Canadians across the country. It can be especially worrisome if you’re still just getting [...]

Market Matters: May 2022

Market Matters: May 2022 Presented by Mackenzie Investments Click here to read more.

Help Your Kids to Understand the Value of Money

You might not consider yourself one of the best money managers in Canada. But, that doesn’t mean that you can’t help your kids get a head start on learning some good financial habits. The idea is to make learning this new skill fun and easy. Here are a few [...]

How to Turn Your Money Management Into a Game

We have all seen all the headlines: Canadian inflation is up 6.8%, gas prices are soaring, and everything is becoming more expensive. The rising cost of living also makes it harder to manage our money goals, like paying off debt and saving for rainier days. However, with a little [...]

Additional Market Insights from Canada Life (English Only)

Market insight – Market volatility, fueled by multiple factors, may be here for the long term On this week’s episode of Soundbites: “Asset allocation and diversification are going to be your best friends on the market’s worst days,” says Jack Manley, Global Market Specialist with JPMorgan Asset Management. Hear [...]

Canada Life Webinar Recordings

2021 Campaign Getting Started – February 24, 2021 Getting Serious – May 19, 2021 Getting Close - September 22, 2021 http://canlife.co/2021webinars 2022 General Don’t let work and life drain you – Learn to recharge – May 4, 2022 Don’t let life drain you - Learn to recharge - YouTube [...]

Market Matters: April 2022

Market Matters: April 2022 Presented by Mackenzie Investments Click here to read more.

Helpful tips on how to sign on to view your RRSP account on MyCanadaLifeAtWork.com

There may be some confusion about how to sign in to access your CEIRP Group RSP through the MyCanadaLifeAtWork.com portal. The MyCanadaLifeAtWork.com portal serves two types of plans, GRS Access (Group RSP) and GroupNet (Group Health Benefits), but they are not integrated so the same credentials won’t work for [...]

Let’s Talk Budgeting

One of the common issues facing CEIRP members is how to budget their money and manage their debt. As the cost of living rises across the country, everyone should learn these skillsets. We know that many of you work long hours, but by just setting aside an hour or [...]

Tools to Help You Smash Your Debt

Automate your debt payments Some of the best known personal finance experts recommend using the debt snowball technique to pay off debt. The idea is to list your debts from lowest to highest, and then set aside an amount of money each month to put towards the different items. [...]

Analysis of the 2022 Federal Budget

Canada Life's analysis of the 2022 Federal Budget. Click here to read more.

Canada Life Webinar: Don’t let work and life drain you – learn to recharge

When we feel overloaded, our tendency is to do just one more thing or push through. Managing this way actually depletes our energy and reduces our focus and productivity. This means we have to work harder and longer to get the same results we’d achieve if we took time [...]

Market Matters: First Quarter of 2022

Market Matters: First Quarter of 2022 Presented by Mackenzie Investments Click here to read more.

2021 Stakeholder Report

The 2021 Stakeholder Report is now available. Click here to read the report.

What To Do If You Discover a Hidden Cash Stash

You know that amazing feeling you get when you find $5 in a bag or jacket you haven’t used in a while? It’s the kind of thing that adds a spring to your step for the entire day, as you try to figure out if you should blow the [...]

Understanding How Investment Income is Taxed

Here’s a simple fact about growing your nest egg: making money is easy. Saving it can be the tricky part. That’s why it’s important to consider how your investments outside your RRSPs are taxed. To illustrate, here are three general tax treatment examples for an individual with an annual [...]

A statement from Canada Life about CEIRP Plan funds and the invasion of Ukraine

Click here to read the statement from Canada Life.

Market Matters: February 2022

February 2022 Market Matters Presented by Mackenzie Investments Click here to read more.

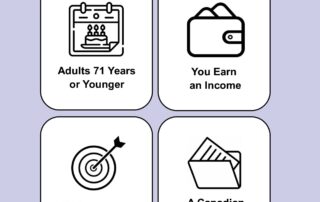

Who is Eligible to Contribute to an RRSP?

The simple answer is a Canadian resident for tax purposes who is 71 years or younger and making an income, up to the individual’s annual contribution limit. So, what if you’re on a temporary work visa or you’re a Canadian citizen who’s lived overseas for a while and have [...]

It’s Never Too Late to Become Financially Resilient

We can all agree that the instability of last two years have been a challenge financially for many Canadians. However, a recent Canadian survey found that 40% of respondents were able to continue to contribute to their RRSPs, according to Benefits Canada, a financial industry trade magazine. In fact, [...]

Market Matters: January 2022

January 2022 Market Matters Presented by Mackenzie Investments Click here to read more.

Temporary Delay at Canada Life Call Centre

The Canada Life call centre is experiencing a large volume of calls at this time due to the RRSP season. Despite the current message on their system, you have dialed the correct number. Thank you for your patience as they work through the calls and correct the problem. [...]

From the CEIRP Newsletter Archive

Over the last couple of years, the CEIRP membership has grown by 11%! This fantastic growth has made us a bit sentimental. So we looked through our archives and found some timely articles that you definitely can use right now! Enjoy! Did you know? You can set up automatic [...]

2021 capital markets year in review

2021 capital markets year in review Presented by Mackenzie Investments Click here to read more.

Tips to make 2022 even better, financially

Over the last few weeks, there have been several stories in the news about the rising cost of living and the potential of interest rates also increasing in the coming year. Instead of allowing this news to worry us, there are good money managing habits that we can adopt [...]

Helpful reminders about the upcoming RRSP Season

As the holidays come to a close and a new year starts, so to does RRSP season. Here are some of the articles we’ve posted to the website this year with useful tips on how to contribute more to your retirement savings: Overcoming Retirement Saving Hurdles RRSP 101: Quick [...]

Market Matters: November 2021

Summary for November 2021 Presented by Mackenzie Investments Click here to read more.

Market Matters: October 2021

Summary for October 2021 Presented by Mackenzie Investments Click here to read more.

Now Available: Important deadlines for RRSP & TFSA

Canada Life has now released its important dates and deadlines for RRSPs and TFSAs for the remainder of 2021 into 2022. Download your copy here or through your RRSP account on mycanadalifeatwork.com. Don't forget, there are a few ways that you can make additional RRSP contributions. Click here for [...]

Overcoming Retirement Saving Hurdles

A common concern of many Canadians is: “I can never retire.” It’s usually followed by: “I haven’t saved enough.” These worries are understandable since we live and spend money in the “now.” It’s much harder to visualize how we’ll live and spend money in retirement when it may be [...]

Increasingly, Canadian Women are Becoming Household Financial Managers

Over the last few years, the financial industry has taken note that women are taking more responsibility for personal and household financial decisions. A recent article in the Toronto Star on the subject noted that 90% of Canadian women will find themselves in this role by way of personal [...]

Are you turning 71 in 2021? Here’s what you need to know

If you are turning 71 this year you will need to close your RRSP by December 31. This being said, it doesn’t mean you have to leave the CEIRP plan. You may have already been contacted by Canada Life and have made a decision about opening a CEIRP RRIF. [...]

Adopting Good Financial Habits in Your 20s, 30s and 40s

Here are some ideas on how to stay financially disciplined starting in your 20s through to your 40s: Twenty-something: Do you know where your money goes? Knowing how you spend money now will benefit you in the long-term. There are lots of financial apps that you can try, which are [...]

Market Matters: Third Quarter 2021

Summary for the Third Quarter of 2021 Presented by Mackenzie Investments Click here to read more.

Market Matters: August 2021

Summary for August 2021 Presented by Mackenzie Investments Click here to read more.

RESPs to the Rescue!

With the summer ending and fall here, schooling and education tends to be top of mind for many families. With the rising costs of post secondary education, many families wonder how and when to start saving. It can be difficult for students to cover post-secondary expenses from their earnings [...]

A TFSA Refresher

TFSA stands for the Tax Free Savings Account Anyone can have an account—almost: Any Canadian resident over 18 years old can contribute to a TFSA. Annual limit: In 2022, the contribution limit for TFSA is $6000. For this year, your cumulative contribution limit is $81,500. Withdraw funds with ease: [...]

RRSP 101: Quick FAQs About Individual and Group RRSPs

Some members might not be sure about how Individual and Group RRSPs work. Here's a quick refresher sourced from the Canada.ca website: The Registered Retirement Savings Plan helps you save for retirement during your working years You can contribute 18% of your previous year’s income (total limit for 2020 [...]

Market Matters: July 2021

Summary for July 2021 Presented by Mackenzie Investments Click here to read more.

We did it again! The investment management fees are lower!

CEIRP keeps growing which means we can all enjoy lower investment management fees! When the plan started in 2004, fees were 1.1%. After six reductions, the fees will now be reduced by .5% to .48% — a 56.4% reduction since our inception. This change applies immediately to the RRSP, [...]

This year, staycations are an economic benefit for all

We can all agree that it’s been a long year and a half for everyone. As each day passes, the sense of renewed freedom is spreading across the country. Despite that, many of the local summertime events have been cancelled again this year. So, what can you do in [...]

Market Matters: Mid-year review

2021 capital markets mid-year in review Presented by Mackenzie Investments Click here to read more.

Helping Your Child Plan For Their Post-Secondary Education

We can all agree that this school year has been challenging and unpredictable. With so much uncertainty, it may seem ridiculous to even make plans for the next school year. But, things are looking up and September will be here soon enough, so it may be safe to start [...]

As of July 1, RESPs will now be available through CEIRP

We’re always looking for new ways to help you save for tomorrow. Now you can save for a child’s education by opening a Registered Education Savings Plan (RESP). Click here to learn more.

Reminders from the CEIRP Office

Gentle reminders: RESPs are now available through CEIRP. Click here to learn more. If you're looking to make any changes to your RRSP contributions, contact your Group RSP Administrator The CEIRP website is your first stop to find information and other resources about the CEIRP plan. Be sure to [...]

Market Matters: May 2021

Summary for May 2021 Presented by Mackenzie Investments Key Highlights: The central banks of South Korea and New Zealand are taking a firmer tone, as is the Bank of Canada Crypto-currencies plunge Canadian equities perform well on the back of stellar earnings Inflation beats already high expectations Click here to [...]

Update from the CEIRP Office: May 2021

Gentle reminders: The CEIRP website is your first stop to find information and other resources about the CEIRP plan. We’ve also made a few updates including new article and video archive pages found under the “About CEIRP” tab Log on to mycanadalifeatwork.com to update all your personal information, including email, [...]

Do You Have a Retirement Savings Strategy?

We all know that we need to have a strategy if we expect to reach our goals. The same can be said for saving for retirement. The idea is to define your retirement objectives and decide how you’ll achieve your savings plan. To get started, ask yourself: How do [...]

Three Financial Conversations to Have Before You Say “I do”

As life slowly gets back to normal, we’re all looking forward to reasons to celebrate. In the coming months, an increase in weddings might be included in that list. So if you and your partner have been dreaming of when to have your big day, here are some financial [...]

Market Matters: April 2021

Summary for April 2021 Presented by Mackenzie Investments Key Highlights: Canadian budget released President Biden unveils his $1.8 trillion American Families Plan US equities regain their global market leadership Q1 2021 corporate earnings shatter expectations Click here to read more.

5 Essential Pieces to Have in Your Estate Plan

On the surface, estate planning isn’t very exciting. But, it’s actually an important part of your financial plan. It ensures that your assets are protected and that your final wishes are carried out correctly. Here are five essential pieces that you should include in your plan: Consult with a [...]

The AFC Newsletter: March 2021

In This Issue: Message from the Executive Director Now Offering: Mental Health First Aid Training Career Resilience Workshop: Sharpen Your Interview Skills World Theatre Day 2021 - Thank You to Our Supporters Wheat + Sea Collective Launches #onlyintermission Tee Big Swing 2021: Save the Date Click here to access the [...]

Update from the CEIRP Office: March 2021

Gentle reminders from the CEIRP Office: The CEIRP website is your first stop to find information and other resources about the CEIRP plan. We’ve also made a few updates including new article and video archive pages found under the “About CEIRP” tab Log on to mycanadalifeatwork.com to update all your [...]

Protecting Yourself Against Identity Theft

Knowing the signs of identity theft is the best way to arming yourself against becoming a victim. So, what exactly is identity theft? It happens when somebody takes and/or uses your personal information, like your credit card number, driver's license, SIN, birthdate, to commit a crime like fraud. Luckily, there [...]

For Your Information: A Great Newsletter from the Financial Consumer Agency of Canada

Every month, the Financial Consumer Agency of Canada (FCAC) produces a newsletter with excellent financial tips and information. Seeing as March has been Fraud Prevention Month, here are a few useful articles on how to protect yourself against financial fraud:1 in 3 Canadians are targets of financial fraud during [...]

Market Matters: February 2021

Summary for Febuary 2021 Presented by Mackenzie Investments Fixed income investors bruised as global bond yields surge amid increasing confidence for a robust economic rebound in the second half of 2021 Canadian equities deliver strong performance; powered by the cyclical rotation trade and soaring commodity prices US House of Representatives [...]

The AFC Newsletter: February 2021

In This Issue: Message from the Executive Director COVID-19 Virtual Donor Wall Wil, a Star-studded Virtual Table Read and Fundraiser A Safe Space to Talk and Connect: Designated Sharing Time Tune in for the Final Show of Big Girl & Friends Season 2 Click here to access the full newsletter.

Update from the CEIRP Office: February 2021

Making Direct Contributions to Your RRSP or TFSA are Now Even Easier! Most financial institutions have now updated their bill payee list to include Canada Life Group RRSP and Canada Life Group TFSA. This means you can make direct contributions to your RRSP and/or TFSA by setting it up as [...]

Overcoming Retirement Planning Procrastination

When it comes to creating a robust retirement plan, a lot of us tend to put it off. One reason may be because it’s difficult to imagine what life will be like in five, 10, 20 years from now. Another possible reason is that we may become overwhelmed by the [...]

The Joys of Compound Interest

Outside of your RRSP, the TFSA is a great savings tool to help you achieve your short- and long-term goals. For example, let’s say you wanted to travel around Italy for three-weeks sometime in the near future — say, in five years. If you started with an investment of $25 [...]

Market Matters: January 2021

Summary for January 2021 Presented by Mackenzie Investments COVID-19 cases decline sharply amidst vaccine rollouts; virus mutations remain a concern Under heavy security post the US Capitol riot, US President Biden takes office: Signs 42 executive orders and proposes a $1.9 trillion fiscal stimulus bill Heavily shorted stocks: GameStop, AMC [...]

Making Additional Contributions to Your RRSP or TFSA is Now Even Easier!

Most financial institutions have now updated their bill payee list to include Canada Life Group RRSP and Canada Life Group TFSA. This means you can make direct contributions to your RRSP and/or TFSA by setting it up as a bill through your online banking. Just search for “Canada Life” in the bill [...]

The Socially Responsible Investments Balanced Fund Will Soon Have a New Name

For those among you that own units in SRI Balanced Fund (GWLIM), CEIRP’s Socially Responsible Investment Option, please be aware that Canada Life has announced that it is changing its name to SRI Balanced Fund (Mackenzie). Why is there going to be a name change? This change is following the [...]

Navigating the new MyCanadaLifeAtWork.com Login during RRSP Season

RSP season means a higher volume of calls to the Canada Life call centre and waiting times to speak to a Client Service Representative may be longer than usual. There are a number of things you can do what you log onto your account including updating contact information and downloading [...]

The AFC Newsletter: January 2021

In This Issue: Message from the Executive Director COVID-19 Virtual Donor Wall Career Resilience Program: Applications Open Now Share Your Thoughts at Designated Sharing Time BIG GIRL & Friends is Back! Click here to access the full newsletter.

Update from the CEIRP Office: January 2021

Glide Path Changes CEIRP always aims to make retirement saving easy for you. With simplicity in mind, the plan offers three investment style options: No Touch featuring the Cadence Target Date Funds, which offer a single-fund solution that leaves the decisions to investment professionals. Low Touch featuring the Portfolio Target [...]

Top Up Your RRSP for 2020

At the beginning of this month, a great suggestion came from a plan member: now is the perfect time to top up your RRSP if you received CERB or CEWS earnings. This is especially true as many will be required to repay the benefit on their upcoming taxes, which is [...]

Galvanize Your 2021 Financial Resolution with an Emergency Savings Plan

We can all agree that it’s good that 2020 is finally over. It was a year of unprecedented volatility across all areas of life. And it shone a painful light on how carrying too much debt and too little savings can make everything even more difficult. The good news is [...]

2020 Capital Market Year in Review

Market Matters has now been replaced by Market Review, presented by MacKenzie Investments. The report will be posted here each month. The French version will be available starting in February. Click here to read the report.

Update from the CEIRP Office: December 2020

New sign-in page for your CEIRP plan You may have noticed something a little different when you go to log on to your account on www.grsaccess.com. You, the Plan member, will be redirected to the new sign-in page, www.mycanadalifeatwork.com. From there, using your Access ID and password, you can access [...]

Financial resolutions for 2021

It’s hard to believe after the difficulties of the last twelve months that we’re just a few days away from waving 2020 goodbye and giving 2021 a huge welcoming hug. We can also all agree that we’ve been through the wringer, especially on the financial side. It’s safe to say [...]

Looking forward to 2021: Reinvest in the simple things

Fatigue has been one of the recurring themes in 2020. Whether it be lockdown fatigue, isolation fatigue, cooking fatigue, Covid fatigue — you name it, we’ve been fed up. To be fair, there were times when we found reasons to smile. Many of us began to appreciate the simple things [...]

Market Matters: November 2020

Highlights: News of a promising COVID-19 vaccine trial helped spur strong global stock market gains and a significant sector rotation from growth into value sectors. Beginning in 2021, GLC will be amalgamated into Mackenzie Investments and together we will be stronger as one of Canada’s largest asset managers. The drawn-out [...]

Important deadlines for RRSPs and TFSAs

Click here to download the PDF document.

Update from the CEIRP Office: November 2020

Some gentle reminders for you: Don’t forget that CEIRP now has social media communities, and we’d love for you to follow us. We’re on Twitter and Facebook — drop by with a “like”, to leave a comment or question, or just say hi! Looking forward to “friending” you! Don’t forget [...]

Tips to Make the Most of this Unusual Tax Season

While it may be cliché to say this out loud, but we can agree that 2020 had more plot twists and turns than a high-grossing blockbuster. There have been so many unknowns and sources of anxiety: Will my project restart allowing me to work again? Will my government support be [...]

Great Personal Finance Management Websites

There are tons of great personal financial websites that offer advice on budgeting, goal setting and how to avoid/eliminate debt. Here are a few that you should check out: The Financial Consumer Agency of Canada Chartered Professional Accountants of Canada: Covid-19 related personal financial tips Rags to Reasonable smartPATH

Market Matters: October 2020

Highlights: Rising COVID-19 infection counts continue to stifle economic recovery across North America and Europe. Equity markets and investor sentiment weakened as U.S. election uncertainty loomed throughout the month. Bond yields rose sharply early in the month, only to land back roughly where they started. Click here to read more.

The AFC Newsletter: October 2020

October 2020 Newsletter In This Issue: Message from the Executive Director Launching The AFC's Career Resilience Initiative Financial Wellness Videos Series Vitality Monthly Giving Campaign Stratford Festival's Guthrie Committee Donates $25,000 to The AFC CSARN's Maintaining Creativity Conference

Update from the CEIRP Office: October 2020

Join the CEIRP Social Communities! CEIRP now has its own bilingual Facebook and Twitter communities. We’ll be posting financial tips and other information you can use, especially throughout November which is Financial Literacy Month. So be sure to follow us — we’ll even follow you back!

Market Matters: September 2020

Highlights: COVID-19’s second wave offers up a new round of uncertainty for businesses. The Federal Reserve kept their Fed funds target range steady at between 0% to 0.25%. September losses give back some of their summer-time equity market gains. Oil prices fell on rising concerns over weak global demand if [...]

“Freedom 65+” is Now the New Normal

Do you remember the “Freedom 55” ads? These days, retiring in your 50s is only for a lucky few. “Freedom 65+” is more realistic for most Canadians. And according to Benefits Canada, it’s not merely realization facing Boomers and Gen Xers; Millennials are also coming to the same conclusion. Of [...]

A Retirement Planning Tip for Women: Contribute Early and Often

This year, the United Nations increased the average Canadian life expectancy to 82.52, an .18% increase over 2019, with the average Canadian woman living to 84. Also, the gender pay gap continues to decrease. So for these two reasons, it’s important that women are proactive about their retirement plan. Saving [...]

Update from the CEIRP Office: September 2020

Reminder about CEIRP’s dedicated Investment and Retirement Managers at Canada Life The fastest way to successfully reach your goals is having a plan. This is especially true for those close to retirement. Were you aware that Canada Life has three Investment and Retirement Managers dedicated to CEIRP members? They can [...]

It’s Never Too Late to Have a Plan

Every year, the Financial Consumer Agency of Canada (FCAC) conducts a survey to study how well Canadians understand and manage their personal finances. In May, the agency released its findings from the 2019 survey. What remains true is that Canadians still live pay cheque to pay cheque, are carrying a [...]

Tips for Protecting Your Home-based Business

If you count yourself among many creative professionals across Canada who run their businesses from home — especially now because of Covid — do you know how well you are protected from loss, damage or theft? You may be surprised to know that your regular home insurance may not cover [...]

Market Matters: August 2020

Highlights: Global stock markets extended their summer-long run. Bond markets checked back, with longer-term bonds hit hardest. Expectations for market volatility rose with stretched stock valuations, the approach of the U.S. presidential election and concerns for a COVID-19 second wave. Amidst a risk-on sentiment, oil prices rose sharply, while gold [...]

The AFC Newsletter: August 2020

In This Issue: Message from the Executive Director COVID-19 Virtual Donor Wall Big Swing 2020: Gold Sponsor Spotlight Last Chance for Big Swing 2020 Raffle Tickets PAL Stratford's Expect the Extraordinary Fundraiser Rendezvous with Madness Festival

Update from the CEIRP Office: August 2020

An update about the RRSP Email Campaign: There has been a great response to our email campaign to encourage the Federal Government to allow our members and other Canadians to “borrow” from their RRSP with no tax implications during the pandemic. But there’s still more we need to do in [...]

3 Money-Managing Tips for the Gig Economy

We can all agree that 2020 has been a particularly trying year. And this is especially true for so many working in the Gig Economy, where financial ups and downs are so prevalent. The good news is that there are steps you can take now to adopt new money managing [...]

Market Matters: July 2020

Highlights: GLC and Mackenzie join forces to become the largest asset managers in Canada. S&P 500 turns positive on the year and the price of gold hits an all-time high, while bond yields fell to all-time lows. COVID-19 case number progress (or lack thereof) remains key factor in economic outlook. [...]

The AFC Newsletter: July 2020

In This Issue: Message from the Executive Director COVID-19 Virtual Donor Wall Big Swing 2020: Platinum Sponsor Spotlight Big Swing 2020 Raffle Behind the Scenes Mental Health and Suicide Prevention Initiative Financial Wellness E-zine

Email Campaign: Temporary Emergency Program

In April, the CEIRP, the IATSE and the DGC joined in lobbying the Federal government to institute a temporary emergency program, similar to the Home Buyers and Lifelong Learning plans, which would allow an individual to “borrow” from their RRSP with no tax implications. There has been no announcement made [...]

Market Matters: June 2020

GLC Insights (Click on the link to access the report): 2020 Mid-Year Market Review

Even During a Pandemic, There are Options for Managing Your Personal Debt

Even During a Pandemic, There are Options for Managing Your Personal Debt In early spring, when the Federal government began releasing its plan to help Canadians during the pandemic, it also asked the banks to lower their credit card interest. They knew that Canadians would likely be using their cards [...]

Taking a Mid-Year Financial Snapshot

Taking a Mid-Year Financial Snapshot We can agree that 2020 has been a difficult year financially for millions of Canadians. When the state of emergency started, many of you were likely starting projects that have since been postponed or cancelled. Now four months later, the good news is that many [...]

Update from the CEIRP Office: June 2020

Member Concerns Q&A Q: I’ve been informed that there is a big possibility of a financial crash in the coming weeks and that it may last a few months. What are your thoughts on this and what is CEIRP’s position? A: Since mid-March, when the emergency measures were enforced to [...]

Update from IATSE: May 19, 2020

Volunteer to help IATSE members in need! The IATSE has launched a website entitled IATSE C.A.R.E.S. (Coronavirus Active Response and Engagement Service). In french, the site is IATSE A.I.D.E. (Assistance des Individus en Difficulté face à l’Épidémie). The website, located at EN: www.iatsecares.org and FR: www.iatsecares.org/francais/, is a new initiative [...]

Update from Canada Life: May 26, 2020

Talk to debt experts for free, they can help, and free webinars and tools to help you through the pandemic. […]

Understanding Market Volatility

Click on the link Understanding market volatility

Market Matters: May 2020

GLC Asset Management - GLC Market Matters May 2020

Your account on MyCanadaLifeAtWork.com

Did you know that when you log on to your account on www.mycanadalifeatwork.com you can: update your mailing address and telephone number print off a duplicate tax receipt update your email address view your last statement check your account activity find out your personal rate of return change your future [...]

Say hello to Canada Life

On Jan. 1, 2020 The Great-West Life Assurance Company, London Life Insurance Company, The Canada Life Assurance Company and two holding companies amalgamated. They are now one company – The Canada Life Assurance Company™. You’ll start seeing the Canada Life brand on your member site and in other plan materials starting right away. [...]

CEIRP has reduced your investment management fees again!

When CEIRP started in 2004 the Investment Management Fees were 1.1%. And there have been 5 fee reductions since 2004. Effective December 15, 2019 the Investment Management Fees in the RRSP, NRSP, TFSA and the RRIF/LIF were reduced by 0.15% and are now 0.53%. […]

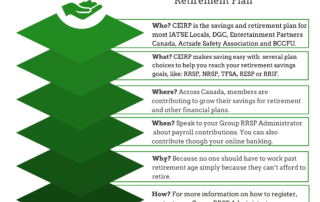

New website. New look. And a new way to communicate with you.

Growing your savings – for life after work. Over the past 15 years, the Canadian Entertainment Industry Retirement Plan (CEIRP) has grown a lot – from the seed of an idea into a large, strong group plan. It was time to make things easier for you and to create [...]

Close to Retirement? Call the Investment and Retirement Specialists

CEIRP now has its own dedicated team of Investment and Retirement Managers at Canada Life. They’re here to help you with those tough decisions about your savings and investments. Contact someone today. Whether you’re just starting out, retiring or somewhere in between, these specialists can help guide you along [...]

Why Assign a Beneficiary

Assigning a beneficiary for your account is really important. If you don’t and you die, your money could get stuck in your estate and caught up with legal fees. But there are different types of beneficiary designations, so make sure you choose the right one – and that it’s [...]

Target Date Funds –Make Investing Easy!

Did you know that our default investment for new members is the Cadence target date funds? For investors who want to set it and forget it, target date funds are the way to go. Just pick “Cadence” and the fund closest to the year you turn age 65 will [...]

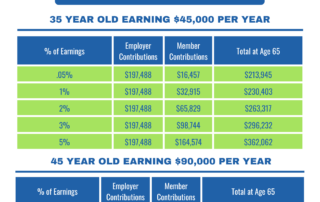

Understanding Your Fees

You have exceptionally low fees compared to individual investments. In fact, the power of CEIRP has helped get fees reduced five times over the years! Your low fees can make a BIG difference to your account balance over time. You hear a lot in the news about how much Canadians [...]